In corporate procurement, we are trained to measure our efficiency by how quickly we can issue a Purchase Order (PO). We assume that the moment the PO is signed and the payment instruction is sent to Finance, the supplier's clock starts ticking.

In practice, this is often where lead time [blocked] decisions start to be misjudged.

The "PO vs. Cash" Disconnect

For a factory, a PO is a legal promise, but it does not buy raw materials. Paper mills and ink suppliers demand cash upfront. Therefore, the factory's production clock does not start when you send the money; it starts when the money clears in their account.

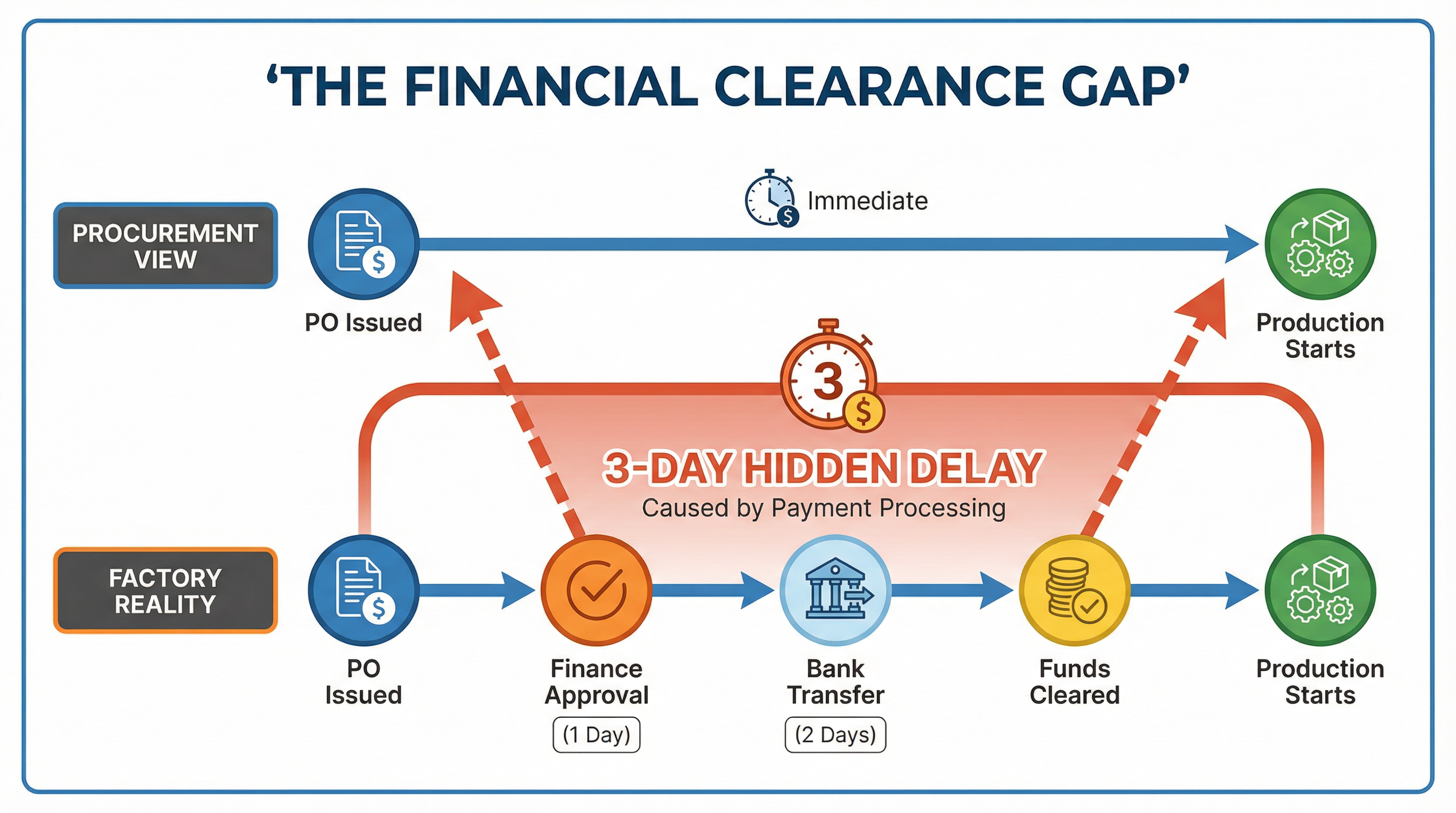

This creates a Financial Clearance Gap—a "dead zone" of 3 to 5 days where the project is technically "live" in your system, but "on hold" on the factory floor.

[Image blocked: Technical timeline diagram comparing 'Procurement View' (PO Issued = Start) vs. 'Factory Reality' (Funds Cleared = Start), highlighting the 3-day hidden delay caused by payment processing.]

The Hidden Delays in B2B Payments

Several factors contribute to this gap, often invisible to the procurement team:

- The Interbank Float: If your Finance team uses IBG (Interbank GIRO) instead of Instant Transfer to save transaction fees, the funds take 1-2 business days to reflect.

- The Friday Trap: A payment initiated on Friday afternoon will not clear until Tuesday morning (assuming Monday is a working day). You have lost 4 calendar days, but the factory has seen 0 working days of progress.

- Compliance Checks: For large corporate gift orders (e.g., RM 50,000+), banks often trigger automated AML (Anti-Money Laundering) compliance checks, holding the funds for an additional 24-48 hours.

Bridging the Gap

To prevent this administrative delay from becoming a production crisis, we must adjust our payment strategy:

- Use Instant Transfers (DuitNow/RENTAS): For urgent orders, the RM 0.50 transaction fee is negligible compared to the cost of a delayed launch. Ensure Finance uses the fastest channel.

- Send Proof of Payment: Immediately email the bank advice slip to the factory. While they wait for clearance, this "good faith" gesture often convinces them to at least book the paper slot or start the artwork process.

- Negotiate Credit Terms: The ultimate solution is to move from "Cash Before Production" to "30 Days Credit." This eliminates the clearance gap entirely, as production starts immediately upon PO issuance.

The Bottom Line: Do not let your project die in the banking system. If the deadline is tight, treat the payment as a critical path milestone, not just an administrative afterthought.

Planning a Custom Notebook Project?

Check our detailed supplier capabilities guide to see what's feasible for your budget and timeline.