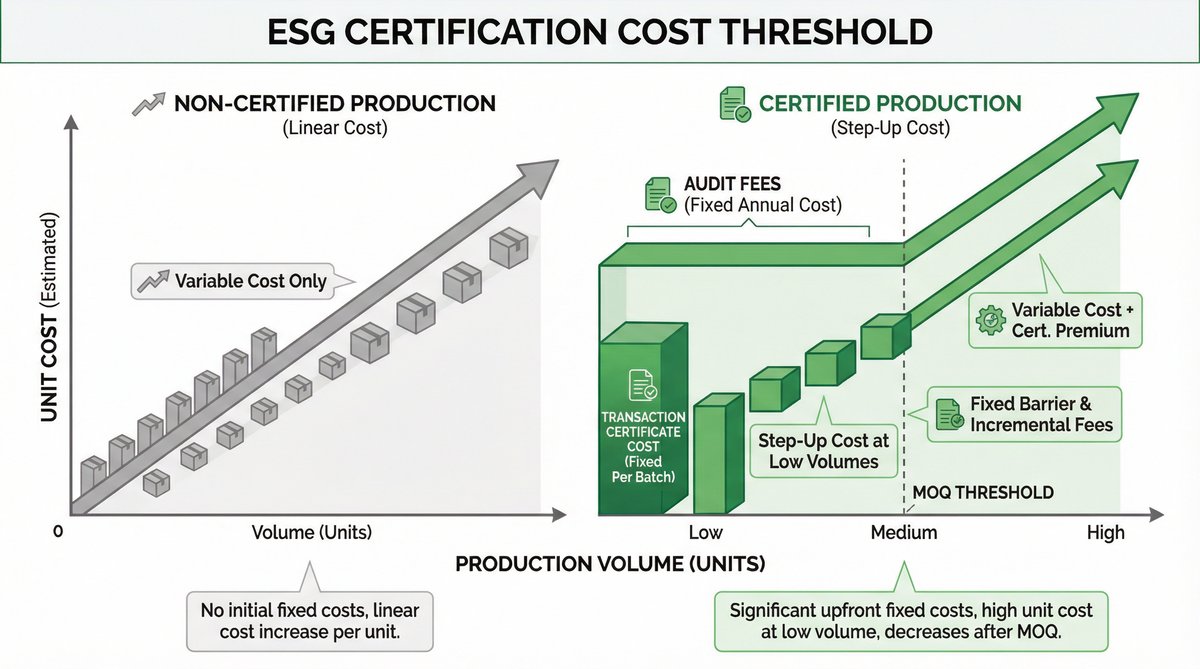

In the current regulatory climate, "sustainability" has moved from a marketing "nice-to-have" to a compliance "must-have" for many Malaysian PLCs and MNCs. However, a critical misunderstanding often occurs when procurement teams attempt to switch from standard materials to Certified Sustainable Materials (such as RPET or FSC-certified paper) without adjusting their volume expectations.

This document outlines the structural reasons why genuine ESG compliance forces a higher Minimum Order Quantity (MOQ), focusing on the Chain of Custody (CoC) and Transaction Certificate (TC) mechanisms.

[Image blocked: ESG Certification Cost Threshold]

The "Transaction Certificate" (TC) Barrier

Unlike standard procurement, where you simply pay for the product, certified sustainable procurement involves paying for the provenance of the product.

For every batch of GRS (Global Recycled Standard) or FSC (Forest Stewardship Council) products, the factory must issue a Transaction Certificate (TC). This is a legal document that traces the material flow from the recycler/forest to the final product.

- The Cost Reality: Issuing a single TC involves administrative fees and third-party audit costs, often ranging from USD 200 to USD 500 per batch, regardless of the order size.

- The MOQ Impact: If you order 100 notebooks, that fixed TC fee might add USD 3.00 (RM 14.00) to every single unit, making the price uncompetitive. To dilute this fixed compliance cost to a negligible amount (e.g., RM 0.50 per unit), the order volume must typically exceed 1,000 to 3,000 units.

In practice, this is often where "Green Procurement" initiatives stall—not because the material is too expensive, but because the certification process is too expensive for small batches.

Chain of Custody: The "Dedicated Line" Requirement

To issue a valid certificate, a factory cannot simply mix recycled pellets with virgin plastic. They must maintain a segregated production line or perform a rigorous "line clearance" before and after the run to prevent contamination.

- Machine Downtime: Cleaning a machine to ensure 100% segregation takes time. A factory will not shut down a high-speed line for 4 hours to run a 30-minute job for 200 units.

- Audit Trail: Every kilogram of input material must be accounted for. The administrative burden of tracking 50kg of material is the same as tracking 5,000kg. Therefore, factories set high MOQs to ensure the administrative effort yields a sufficient profit margin.

The Risk of "Greenwashing" at Low Volumes

Procurement officers should be wary of suppliers offering "Certified RPET" at very low MOQs (e.g., 100 units) without a significant price premium.

- The Red Flag: If the MOQ is low and the price is cheap, the supplier is likely not providing a Transaction Certificate in your company's name. They may be using a "general" certificate or, worse, unverified material.

- The Compliance Risk: Without a specific TC for your batch, you cannot legally claim in your annual ESG report that those specific gifts are certified. You are exposed to greenwashing accusations if audited.

Strategic Recommendation

If your organization requires certified sustainable corporate gifts to meet Scope 3 emission targets:

- Consolidate Orders: Do not buy 500 RPET bags for one event. Combine demand across departments to hit the 3,000+ unit threshold where TC fees become negligible.

- Accept "Self-Declaration" for Small Runs: If volume cannot be increased, accept that for orders under 1,000 units, you may get the material (e.g., recycled plastic) but not the formal certification document (TC). Adjust your internal reporting claims accordingly to avoid legal overreach.

Genuine sustainability is a volume game. The infrastructure required to prove environmental claims is designed for industrial scales, not boutique orders.

Planning a Custom Notebook Project?

Check our detailed supplier capabilities guide to see what's feasible for your budget and timeline.